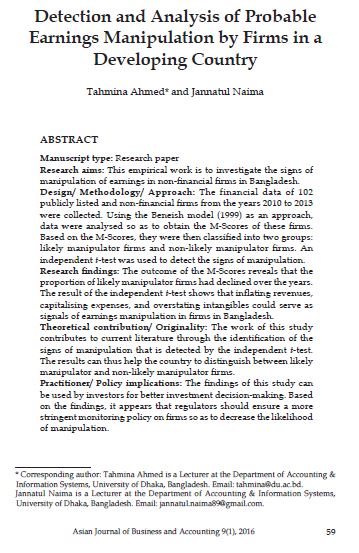

Detection and Analysis of Probable Earnings Manipulation by Firms in a Developing Country

Abstract

Manuscript type: Research paper

Research aims: This empirical work is to investigate the signs of

manipulation of earnings in non-financial firms in Bangladesh.

Design/ Methodology/ Approach: The financial data of 102

publicly listed and non-financial firms from the years 2010 to 2013

were collected. Using the Beneish model (1999) as an approach,

data were analysed so as to obtain the M-Scores of these firms.

Based on the M-Scores, they were then classified into two groups:

likely manipulator firms and non-likely manipulator firms. An

independent t-test was used to detect the signs of manipulation.

Research findings: The outcome of the M-Scores reveals that the

proportion of likely manipulator firms had declined over the years.

The result of the independent t-test shows that inflating revenues,

capitalising expenses, and overstating intangibles could serve as

signals of earnings manipulation in firms in Bangladesh.

Theoretical contribution/ Originality: The work of this study

contributes to current literature through the identification of the

signs of manipulation that is detected by the independent t-test.

The results can thus help the country to distinguish between likely

manipulator and non-likely manipulator firms.

Practitioner/ Policy implications: The findings of this study can

be used by investors for better investment decision-making. Based

on the findings, it appears that regulators should ensure a more

stringent monitoring policy on firms so as to decrease the likelihood

of manipulation.

Research implications/ Limitations: This study only highlights the

pattern of the manipulation of earnings in non-financial firms in

Bangladesh. Further studies need to be conducted in order to detect

the effect of changes in government regulations on manipulation

of earnings in Bangladesh.

Key Words: Accounting Red Flag, Bangladesh, Beneish M-Score,

Earnings Manipulation

JEL Classification: G30, M40

Downloads