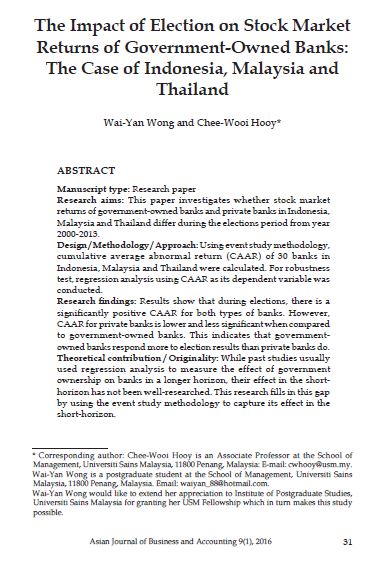

The Impact of Election on Stock Market Returns of Government-Owned Banks: The Case of Indonesia, Malaysia and Thailand

Abstract

Manuscript type: Research paper

Research aims: This paper investigates whether stock market

returns of government-owned banks and private banks in Indonesia,

Malaysia and Thailand differ during the elections period from year

2000-2013.

Design / Methodology / Approach: Using event study methodology,

cumulative average abnormal return (CAAR) of 30 banks in

Indonesia, Malaysia and Thailand were calculated. For robustness

test, regression analysis using CAAR as its dependent variable was

conducted.

Research findings: Results show that during elections, there is a

significantly positive CAAR for both types of banks. However,

CAAR for private banks is lower and less significant when compared

to government-owned banks. This indicates that governmentowned

banks respond more to election results than private banks do.

Theoretical contribution / Originality: While past studies usually

used regression analysis to measure the effect of government

ownership on banks in a longer horizon, their effect in the shorthorizon

has not been well-researched. This research fills in this gap

by using the event study methodology to capture its effect in the

short-horizon.

Practitioner/ Policy implications: The result of this study will

benefit investors as it may help them better understand and evaluate

the political impact on the banking industry during an election.

Research limitation/Implications: Firstly, survivorship bias

analysis cannot be conducted due to the lack of information on

inactive stocks. Secondly, this study could not run a separate

analysis for each country as there was a total sample of only 30 firms

which is the minimum requirement for a reliable statistical analysis.

Keywords: Election, Event Study, Firm Performance, Government-

Owned Banks

JEL Classification: G11, G14, G21

Downloads