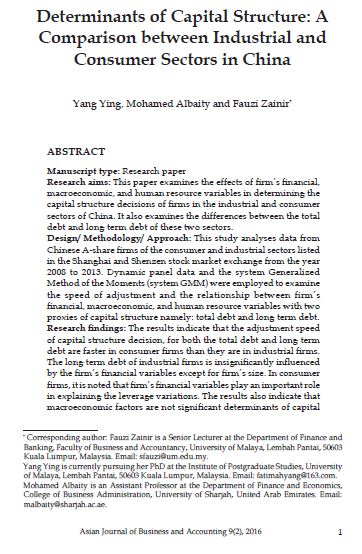

Determinants of Capital Structure: A Comparison between Industrial and Consumer Sectors in China

Keywords:

Adjustment Speed, China, Consumer Firms, Dynamic Capital Structure, Industrial FirmsAbstract

Manuscript type: Research paper

Research aims: This paper examines the effects of firm’s financial,

macroeconomic, and human resource variables in determining the

capital structure decisions of firms in the industrial and consumer

sectors of China. It also examines the differences between the total

debt and long term debt of these two sectors.

Design/ Methodology/ Approach: This study analyses data from

Chinese A-share firms of the consumer and industrial sectors listed

in the Shanghai and Shenzen stock market exchange from the year

2008 to 2013. Dynamic panel data and the system Generalized

Method of the Moments (system GMM) were employed to examine

the speed of adjustment and the relationship between firm’s

financial, macroeconomic, and human resource variables with two

proxies of capital structure namely: total debt and long term debt.

Research findings: The results indicate that the adjustment speed

of capital structure decision, for both the total debt and long term

debt are faster in consumer firms than they are in industrial firms.

The long term debt of industrial firms is insignificantly influenced

by the firm’s financial variables except for firm’s size. In consumer

firms, it is noted that firm’s financial variables play an important role

in explaining the leverage variations. The results also indicate that

macroeconomic factors are not significant determinants of capital structure decisions, especially for industrial firms. In addition,

employment size and employment in industry have significant

positive impact on total debt in consumer firms while employment

size and employment productivity have a negative influence on

the long term debt in industrial firms. Lastly, there is a significant

difference between consumer firms and industrial firms, in term of

the type of debt they carry.

Theoretical contributions/ Originality: This study expands on

previous work done on indirect effects of sectorial and industry

level factors on the relationship between leverage and firm’s specific

determinants of capital structure, in developing economies. It

extends the applicability of capital structure theories that are highly

dependent on the types of leverage despite sector behavioural issues.

Practitioner/ Policy implications: This paper provides insights

on the variables which explain the level and types of leverage of

Chinese firms in both the consumer and industrial sectors.

Research limitations/ Implications: Future studies should consider

other proxies for capital structures such as market value of total,

long and short term debts. Future studies should also investigate

firms in other sectors.

Keyword: Adjustment Speed, China, Consumer Firms, Dynamic

Capital Structure, Industrial Firms

JEL: G00, G32, G39

Downloads