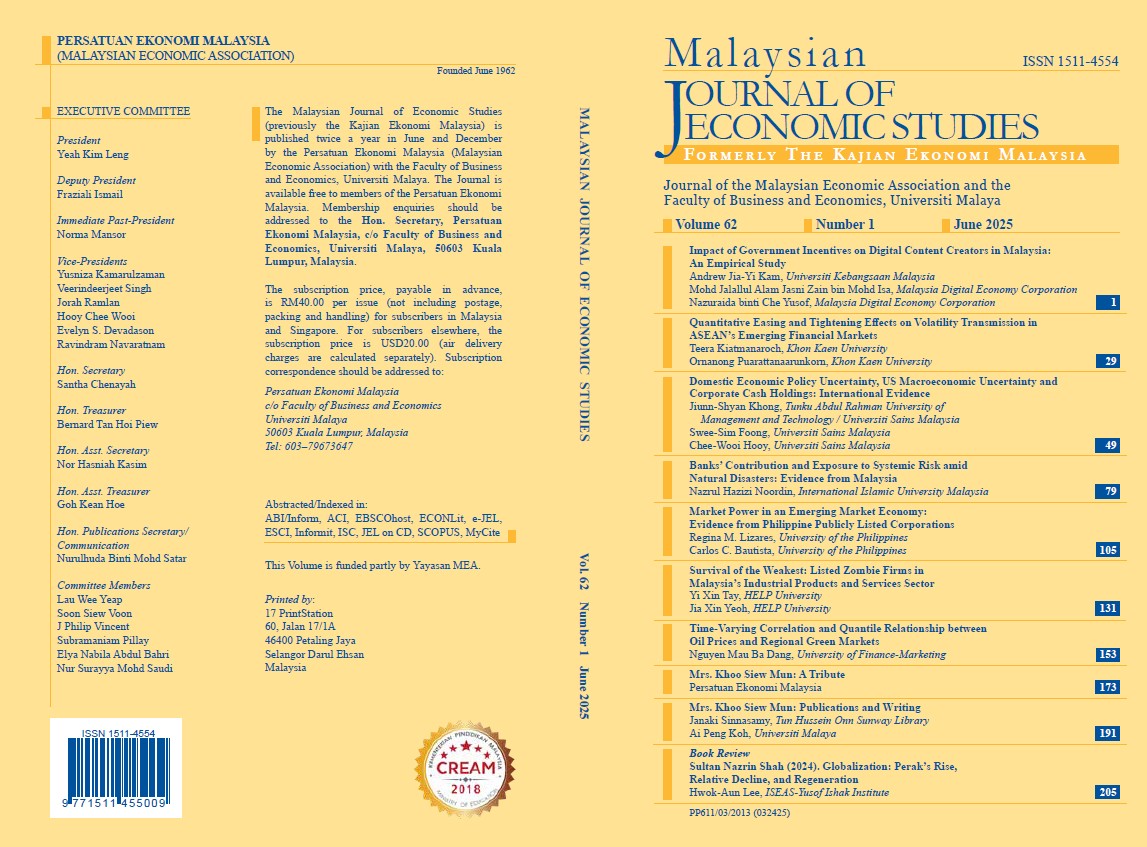

Quantitative Easing and Tightening Effects on Volatility Transmission in ASEAN’s Emerging Financial Markets

DOI:

https://doi.org/10.22452/MJES.vol62no1.2Keywords:

ASEAN stock market, copula, exchange rate, GARCH, volatility transmissionAbstract

This study examines the volatility transmission among four emerging financial markets in the ASEAN region, comprising Thailand, Malaysia, Indonesia and the Philippines, during quantitative easing (QE) and quantitative tightening (QT) policies. A copula-based GARCH model is used to investigate the relationship among the volatility of stock market returns in these four countries and to explore the relationship among their exchange rate returns. Daily data were divided into two periods: the QE period covered 23/3/2020–15/3/2022, and the QT period covered 16/3/2022–13/2/2023. The findings show the relationship among the volatility of stock market returns across four countries, revealing that upper-tail dependence is more prominent during periods of QE than QT. Furthermore, the volatility of exchange rate returns across countries tends to correlate more during periods of QT. This study provides empirical evidence of integration among the financial markets of the four countries, and findings that are valuable for portfolio management. Investors seeking yields in ASEAN’s emerging financial markets should closely monitor the Federal Reserve’s monetary policy, particularly during periods of QT, which pose a higher risk of unexpected negative returns.