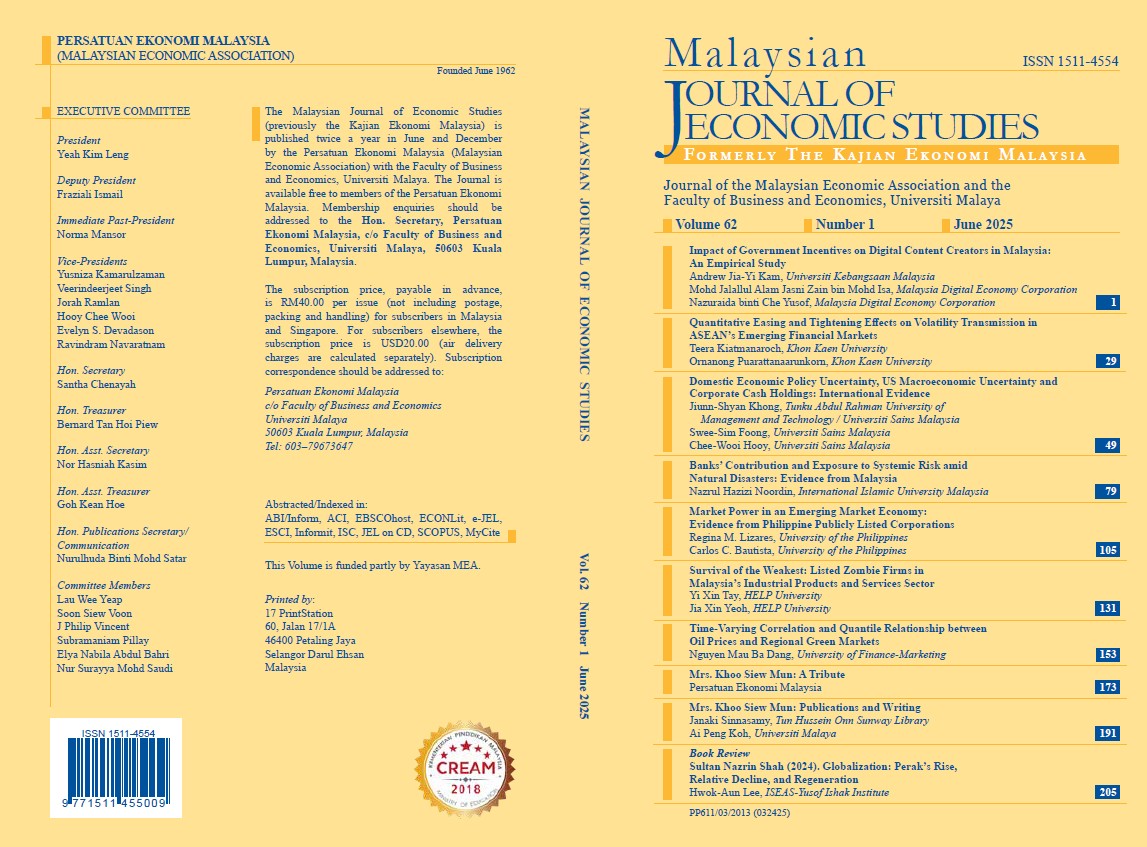

Banks’ Contribution and Exposure to Systemic Risk amid Natural Disasters: Evidence from Malaysia

DOI:

https://doi.org/10.22452/MJES.vol62no1.4Keywords:

Conditional value-at-risk, banks, Malaysia, natural disaster, systemic riskAbstract

This study evaluates the extent to which banks in Malaysia have contributed to and been impacted by systemic risk in the wake of natural disaster events during a period spanning from 1 January 2007 to 31 March 2022. Employing delta conditional value-at-risk measures, our findings reveal that natural disasters, akin to past crises such as the global financial crisis and the COVID-19 pandemic, elevate systemic risk in the banking sector, though the magnitude of their impact is relatively less severe. Additionally, we find that there were more instances, either during the natural disaster event or in its aftermath, where the banks increased their contribution to systemic risk compared to instances where they experienced heightened systemic risk exposure. In terms of timing of the reaction, our analysis shows that the market exhibits a notable delay, with both systemic risk contribution and exposure primarily increasing after the disaster event has concluded, rather than during its occurrence. These results underscore the critical need for climate resilience in the banking industry and provide important insights into the systemic risk implications of natural disasters, particularly in developing, bank-centric countries like Malaysia. They also inform the formulation of targeted policy measures to effectively mitigate these risks.