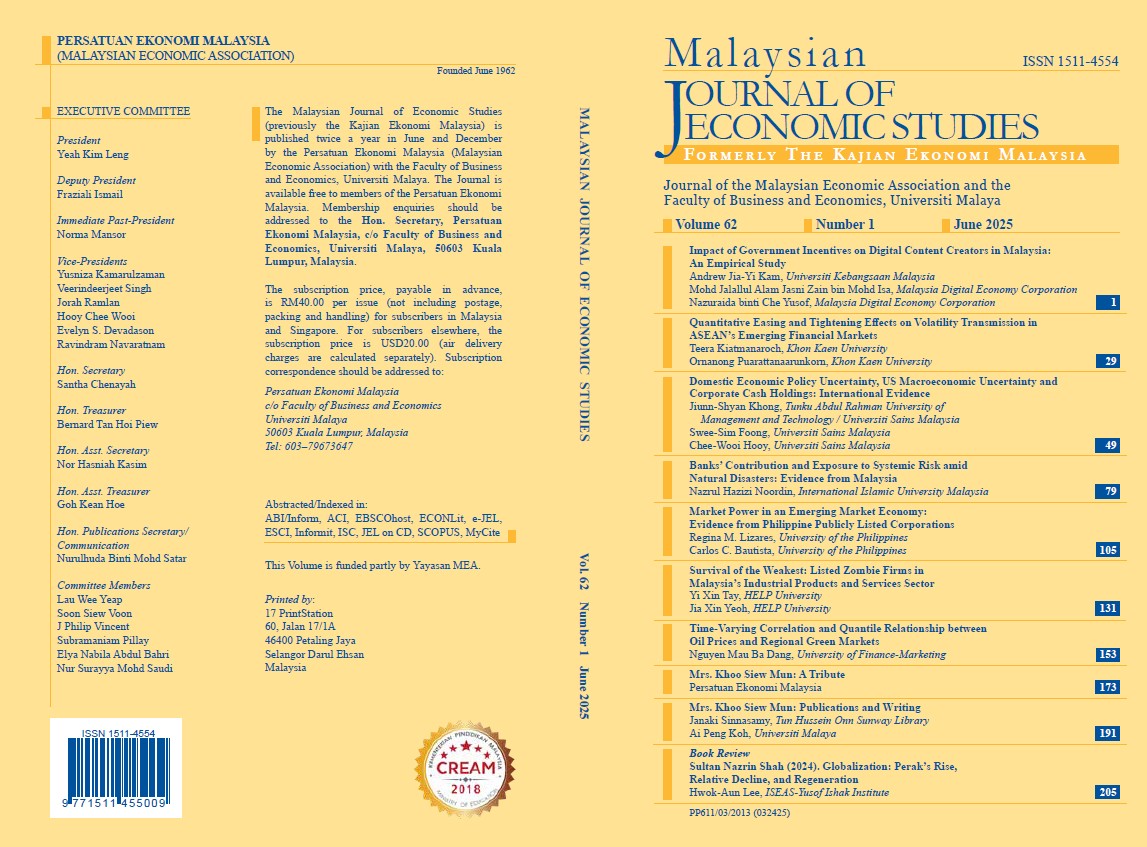

Market Power in an Emerging Market Economy: Evidence from Philippine Publicly Listed Corporations

DOI:

https://doi.org/10.22452/MJES.vol62no1.5Keywords:

Emerging market and developing economies, market power, markup, Philippines, production-based methodAbstract

This study investigates market power trends in an emerging market and developing economy (EMDE), the Philippines, by estimating markups for nonfinancial publicly listed corporations from 2001 to 2019 using a production-based methodology. While corroborating certain findings from advanced economies (AEs) regarding the positive relationship between firm size and markups, as well as markups and profitability, the substantial role larger firms play in markup movements, and the significant inter-sectoral variation in markups, this study reveals key distinctions. Notably, unlike AEs, the Philippines exhibits a more stable aggregate markup trend with limited evidence of consistent upward trend, potentially attributable to the heightened sensitivity of Philippine firms to macroeconomic fluctuations. This is further evidenced by the negative co-movement between markups and macroeconomic variables, such as interest rates and exchange rates. This study significantly contributes to the limited body of literature on market power in EMDEs by providing novel evidence from the Philippines and extending existing research on Philippine markups. These findings provide crucial insights for Philippine policymakers in enabling the development and implementation of more effective competition and antitrust policies to address market power dynamics and foster a more competitive landscape.