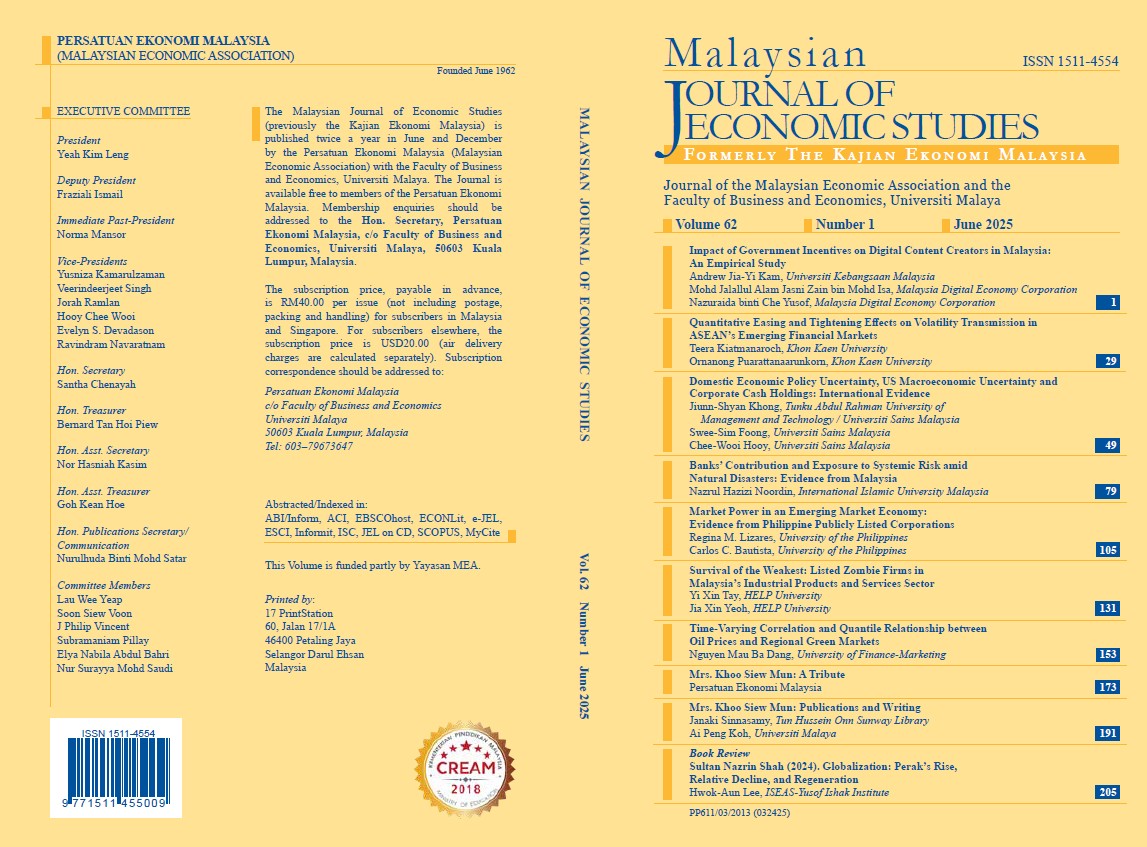

Survival of the Weakest: Listed Zombie Firms in Malaysia’s Industrial Products and Services Sector

DOI:

https://doi.org/10.22452/MJES.vol62no1.6Keywords:

Industrial goods and services sector, Malaysia, zombie companiesAbstract

This study investigates the prevalence and determinants of zombie firms in the industrial goods and services sector listed on Bursa Malaysia from 2011 to 2022. Using the Altman Z-score, Ohlson O-score, and selected financial indicators, we find that 22% of firms with adequate financial disclosures can be classified as “walking dead.” Panel logistic regression analysis reveals that the asset turnover ratio is the most significant predictor of zombification, though its marginal effect diminishes at higher levels. Leverage follows a non-linear relationship, where moderate debt increases the probability of zombification, but excessive debt appears to reduce it ‒ possibly reflecting creditor intervention. Interestingly, firms were less likely to be classified as zombies during the COVID-19 period, potentially due to government relief measures and regulatory forbearance. Despite clear signs of financial distress, most zombie firms are not designated as PN17 or GN3, suggesting limitations in current distress recognition frameworks. These findings offer important implications for policymakers seeking to strengthen regulatory mechanisms and ensure efficient capital allocation. Retail investors may also benefit from improved tools to identify and avoid zombie firms.