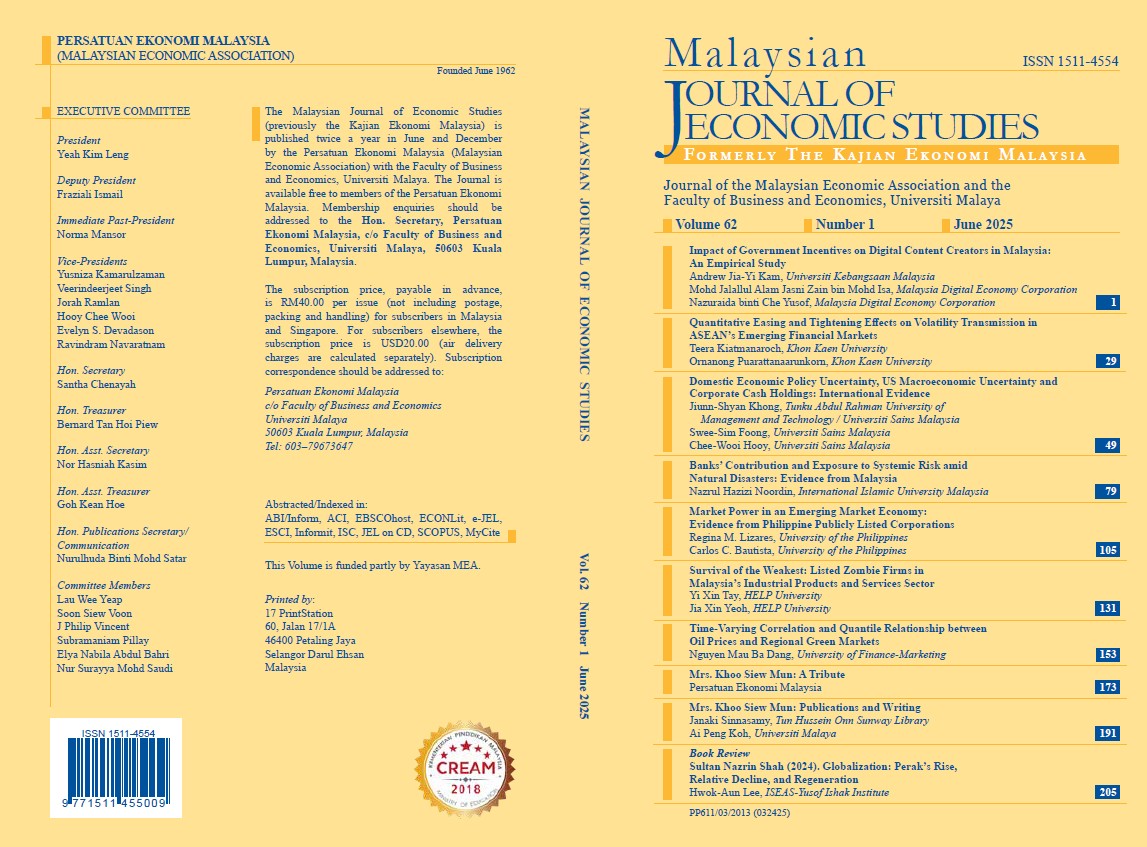

Time-Varying Correlation and Quantile Relationship between Oil Prices and Regional Green Markets

DOI:

https://doi.org/10.22452/MJES.vol62no1.7Keywords:

GARCH-DECO and regional analysis, oil prices, quantile dependence, renewable energy equitiesAbstract

This study examines the time-varying equicorrelation and tail dependence between global oil prices and regional green markets. We use novel approaches, namely the GARCH-DECO model, Quantile-on-Quantile Regression (QQR), and Granger-causality in quantiles. The empirical findings show that global oil prices and renewable energy stock markets are inextricably linked. Specifically, there is a positive equicorrelation between global oil prices and clean energy stock markets. During times of turmoil, these trends become more pronounced, fostering contagion effects that diminish the benefits of diversification between renewable energy stocks and oil portfolios. The outcomes of the QQR technique reveal a heterogeneous interdependence structure between the oil and renewable energy stock markets across the entire distribution. Our results have significant implications for policymakers, investors and traders, as they may assist in understanding the behaviour of renewable energy and oil markets during periods of extreme market stress.